The Road To Pillar II

How to achieve data readiness - A Loctax and EY webinar

Our key takeaways

State of play and legislative updates

- The legislation is complex, scattered and incomplete in a lot of areas. There is substantial ambiguity about some key aspects of the regulations and interactions of various regimes, but most professionals in the tax environment know what Pillar II is hoping to achieve conceptually.

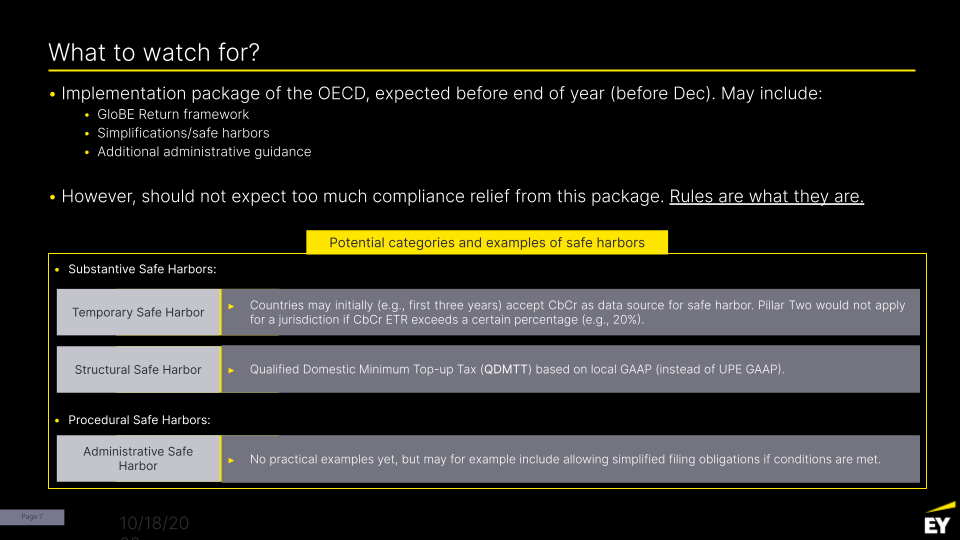

- To get further clarity, tax professionals should keep their eyes out for:

- The OECD implementation package which is expected by the end of December, with details on:

- The GloBE Return Framework,

- Safe harbours, and

- Additional administrative guidance.

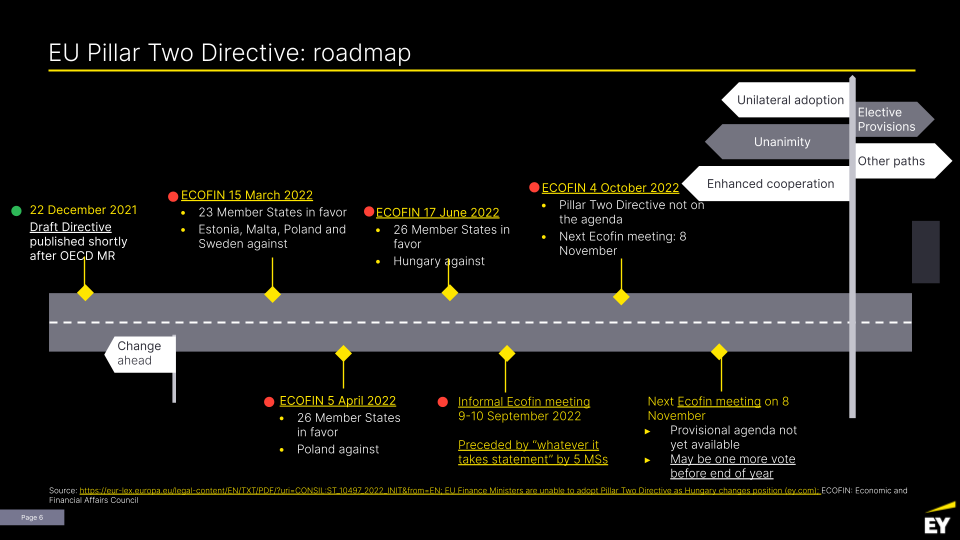

- A draft EU Directive which is expected (hopefully) by the end of the year, depending on agreement among EU Member States.

- There’s also a lot of legislative action at the national level as countries implement various aspects of Pillar II. Some EU Member States are considering moving forward separately if no agreement can be reached at EU level.

- The OECD implementation package which is expected by the end of December, with details on:

.png)

What should companies do now regarding Pillar II and how to start?

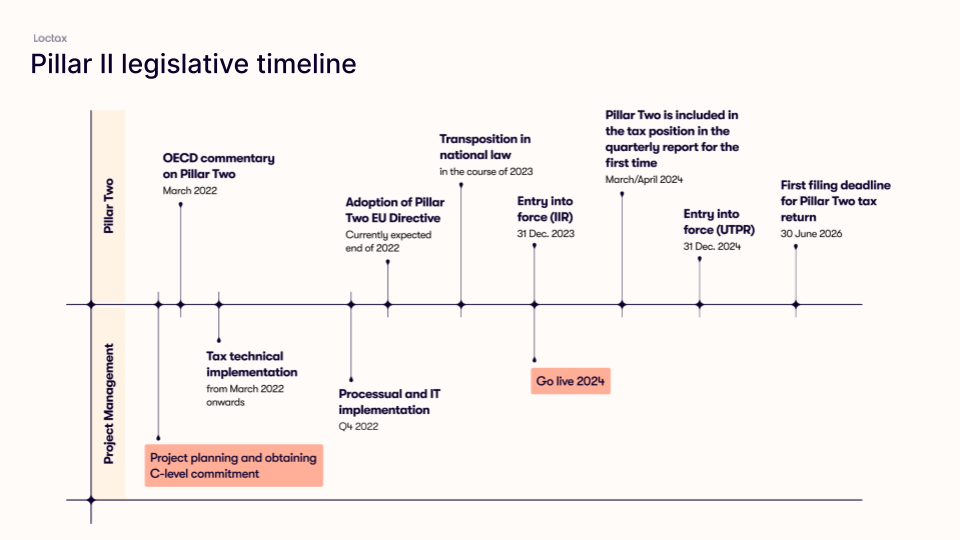

- Pillar II requires action now, regardless of legislative loose ends. A majority of attendees are currently in the process of undertaking an internal impact analysis.

- A step by step approach is required. Identify a project team and clear deadlines. Connect with business partners, collaborate with stakeholders to understand data sources and control the key risks.

- Businesses can look to the Pillar II exercise as an opportunity to become more connected and enable stronger partnerships, strengthening businesses for future (tax) challenges.

- Some companies are already taking steps to include potential Pillar II liabilities in their provision and forecasting exercises, which can highlight some key areas where improvements are required or support is lacking.

Keen to get out of the reactive state?

Feel free to book some time with the Loctax team. We're happy to show how our solution can achieve data readiness and can help you prepare an internal business case.

What (type of) data is required and how to get it?

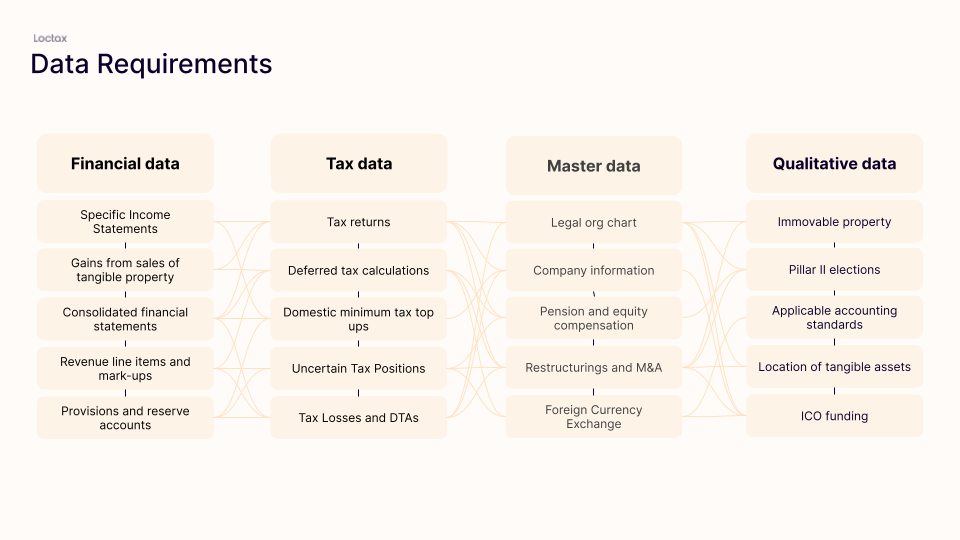

- A lot of data is required, up to 200 data points per entity, for an organisation with 150 legal entities this results in 30.000 data points!

- Data sourcing is a key concern of our attendees. Data is required from all corners of the business and beyond, highlighting the importance of your relationships with stakeholders.

- The quality of data is equally relevant. Tax teams may need to utilise information that was previously only required for internal or secondary purposes, and communicate new demands to data sources.

- To avoid manual labour, teams should consider making the structure scalable and data work for them through technology, workflows and tools. To this end, tax teams should consider their data (quality) requirements now, especially when implementing new processes and ERP systems.

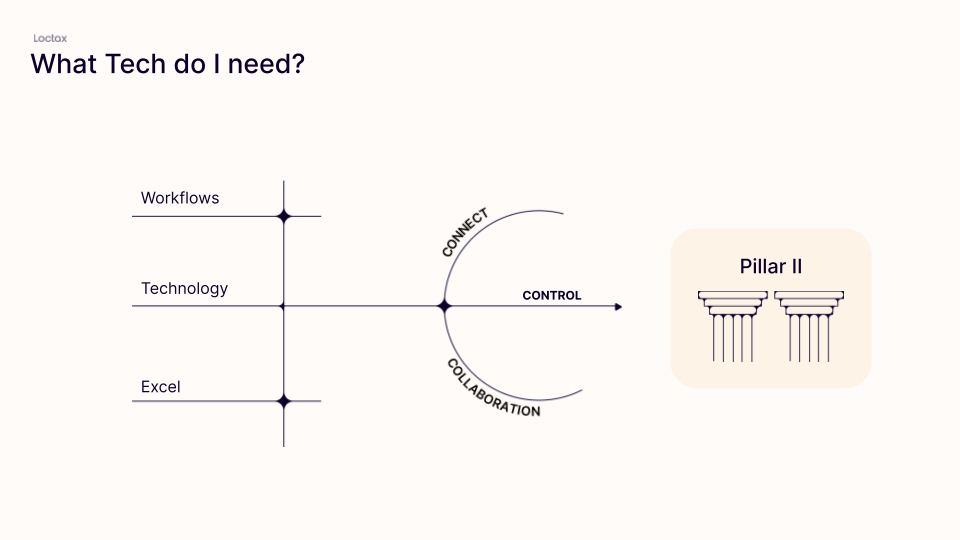

What technology is required?

- Understand your environment as it stands today and where you may need to improve. Excel is an amazing tool and a great baseline but has its limitations in the Pillar II context. It should therefore feature in an overall tax technology and sourcing strategy.

- A majority of our attendees expect to draw from a multitude of sources to deal with the challenges Pillar II poses, such as adviser support, additional hiring and tax technology.

- Technology should enable teams to bring other parts of the business on board. Given the high levels of complexity, data quality standards, automation and an audit trail are required.

- Only when tax teams have comfort on the data can they truly control the process and unlock information for reports, returns and further predictive intelligence.

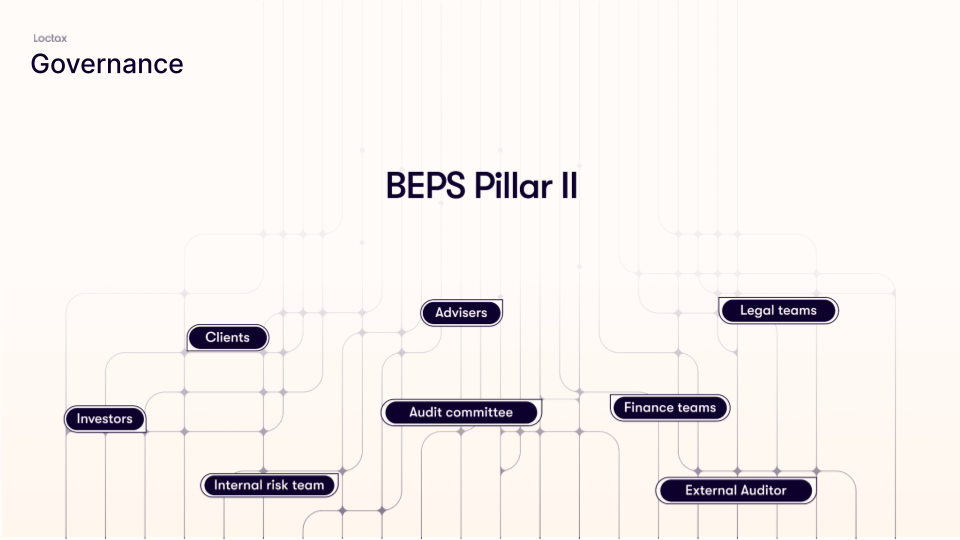

What are important considerations when connecting with stakeholders on Pillar II?

- Although the legislative framework is still uncertain, teams need to anticipate and understand where additional support is needed.

- Aligning with the various stakeholders can be difficult but is absolutely necessary. Your business partners may not be keen to delve into the technical requirements, so identifying disconnects within the organisation early will be required.

- Pillar II is not just an issue for tax teams, but also falls within the scope of the legal compliance framework, and by extension the entire company. The impact of non-compliance on the business and the benefits of getting the exercise right can be very material.

- Communicating these factors appropriately is necessary to garner support and budget from the wider organisation, especially in difficult economic circumstances.

- Tax teams should provide context to motivate and get buy-in early to ensure a timely and qualitative data provision, and a smooth collaboration.